How Letting Agent Data is Handled on the Reports

As is covered on other guides, you need to record the payment made by the tenant to the letting agent and then the payment made by the letting to landlord minus any fees that have been deducted. Landlord Vision will then record that you have received the full amount and paid out the management fees, leaving you with a net gain of what you actually received. This allows you to see how much you are spending on letting agents in your portfolio and allocate this money to your tax reports.

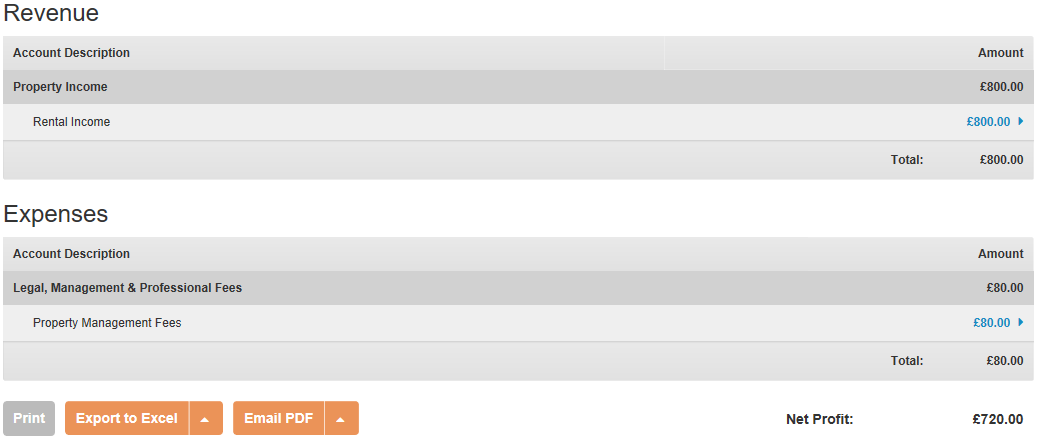

Consider this example of a monthly rent of £800 where the letting agent takes off 10% as a management fee, as shown on the Profit and Loss report.

The landlord received £720 from the agent.

Any further expenses will be added here too.

Customer support service by UserEcho