Adding Mortgages

You can add mortgages in the Finance Manager. It is better to add them here rather than as expenses as you can better track the interest payments for tax relief purposes, plus you can use the loan amount to help you record the property purchase.

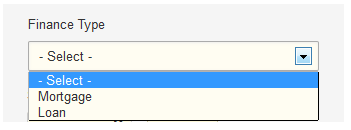

To add a mortgage, go to Finance Manager > Mortgages/Loans and press Add Mortgage/Loan.

There are now five sections to fill in.

Finance Details

The Finance Details section covers the basics of your loan information.

Use the Property Reference to record the property the loan is associated with. Click the + icon to the right hand side of this field to add more properties to the mortgage and assign how much of the loan value goes against which property.

Fill out the details of the loan as it was when you first took it out. Enter the Loan Amount and the Interest Rate as they were at that time. Please see the notes on the screen about the Computation. Different lenders have different ways of tracking daily interest and selecting the wrong one can lead to your loan being quite a bit out after a couple of years. Have a chat with your loan provider to find out what method they use. Please note that Computation is only relevant for repayment mortgages.

Enter the loan amount before any fees and charges were added. You can put these on later.

Set the Payment Period to be either Monthly or Quarterly. If you have selected Quarterly, set how the interest is Compounded.

Enter the Start Date to be the start of the loan and the Term to be the full length of the mortgage. *Do not set this to be the duration of the fixed term period, as you will not be able to change anything once this period ends. We'll go into this further later on.

Now select the Payment Type. If you select Repayment, Landlord Vision will calculate the interest and capital components of your payments so that you can monitor the interest paid amounts separately. If you select Interest Only, Landlord Vision will not reduce the capital amount unless you add in a specific capital repayment for this purpose. This allows you to enter varying interest amounts without affecting the loan amount, which is quite handy if you are on an offset mortgage.

The remaining fields are optional but you can record the Deposit amount, any Equity Released and also the Payment Reference that appears on the bank statement to help with the bank reconciliation, if you are planning on using this feature.

If the interest rate and repayment amounts changed after the mortgage started, we can record this after we've set the mortgage up. Please see this guide.

Account Details

In the Account Details, you can record the accounts used. The Finance Provider Loan Account is the account within Landlord Vision that the payments are assigned to and will dictate where they appear on your Income Tax and Profit & Loss reports. If you are not eligible to claim mortgage interest tax relief, you will need to change the account that it is paid into, this is covered here.

When you take out the loan, Finance Manager will record that you now have that amount of money. Use the Loan Paid To options to record what Finance Manger does with it.

Bank Account will record it against a bank account of your choosing. You will then need to record the purchase of the property in Property Manager > Expenses to offset it.

Non-Bank Account will pay it into a nominal account of your choosing. By default this is the Mispostings account but you can change this. When recording the property purchase in Property Manager > Expenses, you will need to record the mortgage component purchase as a negative amount and assign it to the same account, eg Mispostings. You can find more detail on this here.

Payments

Use the Payments section to record your monthly or quarterly payments. If the mortgage was taken out part way through a month and your Finance Provider calculated a pro-rata amount before the first regular payment, enter this into the Irregular Payment Amount box. Remember that as mortgages are paid in arrears to set the Payment End Date and Payment Due Date one month (or one quarter) before the First Payment Due Date as per the following example.

If you took out a mortgage a long time ago but don't want to track all of the old payments, use this feature to start the Payment Schedule from a more recent date. Enter 0 in the Payment Amount box and again, set the Payment End Date and Payment Due Date one month (or one quarter) before the First Payment Due Date. Then enter an Extra Payment onto the Payment Schedule with the same date as your Payment Due Date and enter the difference between the starting balance and the balance on that date in the Capital Amount box. Landlord Vision will reduce the balance of the loan accordingly.

Please note that Landlord Vision records the payment at the end of the payment period, so it works in arrears. It pays off the interest after it has been accrued.

Tick Automatically Paid if you don't want to manually enter the payments for this mortgage every month.

Early Redemption

To redeem your mortgage before the end of the term, click on the Early Redemption box, enter the date of redemption and penalty details.

Early Warnings

Enable the Early Warning option to make Landlord Vision notify you that the end of the mortgage is approaching. You can also set a specific date so that it will notify you of the mortgage being about to move from a fixed rate period to a variable rate period.

Customer support service by UserEcho