Closing Loans and Remortgaging

If you take out long mortgages but renew them every two years or so when the fixed period ends, you can record this in Landlord Vision. This guide takes you through the process.

Firstly set up your mortgage. There is detailed information here. As before, set the Start Date to be the date the mortgage was taken out, or the date that you have started tracking the loan from in Landlord Vision. Set the Remaining Term to be the number of months left on the whole mortgage (not just the fixed term period) at the Start Date.

If, before you remortgage, the interest rate goes on to the variable rate, you will need to change the rate.

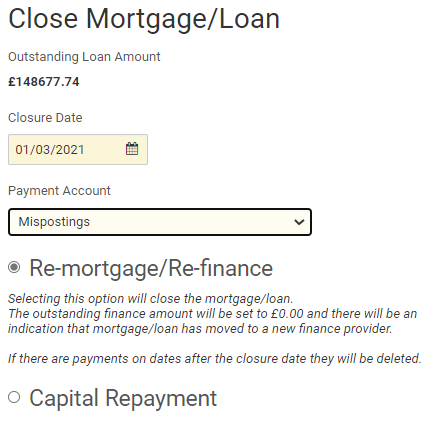

When the time comes to remortgage, ensure all the payments are up to date and head to Finance Manager > Mortgages/Loans > click on the mortgage and at the bottom of the View Mortgage/Loan screen click Close Mortgage.

The system will ask you what option you wish to take, whether you want to completely close the mortgage with a Capital Repayment or Remortgage/Refinance into a new loan.

Enter the Date and select the bank account the loan was paid from. If you select Capital Repayment, the software will write a payment from the bank account to clear the balance of the loan. If the mortgage was actually paid off by the sale of the property, set the Bank Account to Mispostings and refer to the Rcording a Property Sale guide here.

By selecting Remortgage/Refinance you will then be taken to the new mortgage screen where you can set up the details of the new loan. The mortgage amount will be filled in for you but, of course, if you have taken out extra funds then you can simply increase this number accordingly.

Customer support service by UserEcho