Recording a Property Purchase

To record the property purchase, please follow this method.

Enter the Purchase Price and Date in Property Manager > Properties > open the property > Edit > Purchase Details. This will update the Mortgage Broker Summary report and allow the software to calculate your equity and rental yield as well as capital gains. What it wont do is show that you have that amount of property. To do this we need to record an expense in Property Manager > Expenses.

Record the mortgage in Finance Manager > Mortgages and Loans. If the loan amount wasn't paid to your bank account, select Loan Paid To: Non-Bank Account > Mispostings.

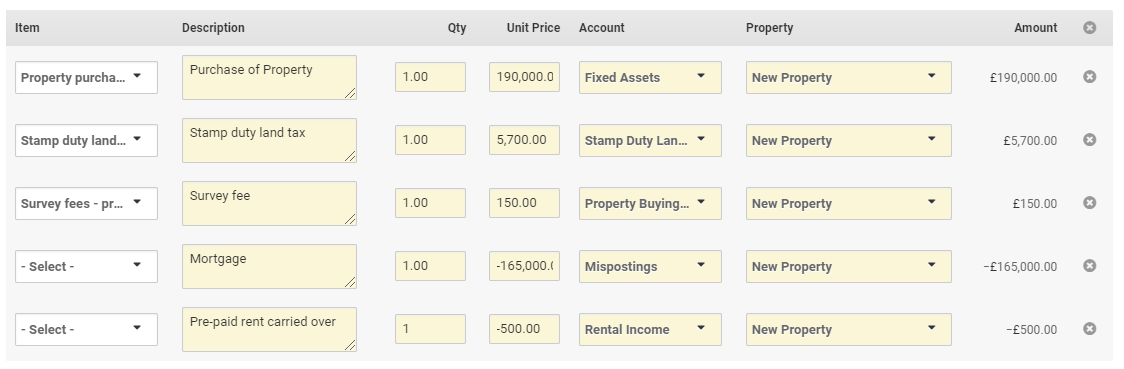

Create an expense for the property purchase and record any further expenses if you need to, such as fees, stamp duty etc.

Any deductions and credits can be recorded by entering a negative value in the Price field. For example if an amount was deducted because the incumbent tenant had paid rent you can record it using this method.

For the mortgage, add a new line and set another negative value in the Price field, this time for the loan amount. Assign this line to the Mispostings account.

Once you've finished everything else, add a payment for the money that came from your bank account to complete the expense.

Please note that the Cost Type should be set to Property Purchase Costs so that it will appear correctly on the Capital Gains report.

Customer support service by UserEcho