Recording Corporation Tax

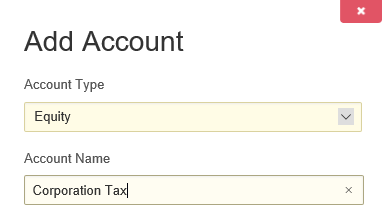

You should record your corporation tax payments in the journal. Firstly, you will need to create an account to record it in. Head to Settings > Chart of Accounts > Add Account and add the following details:

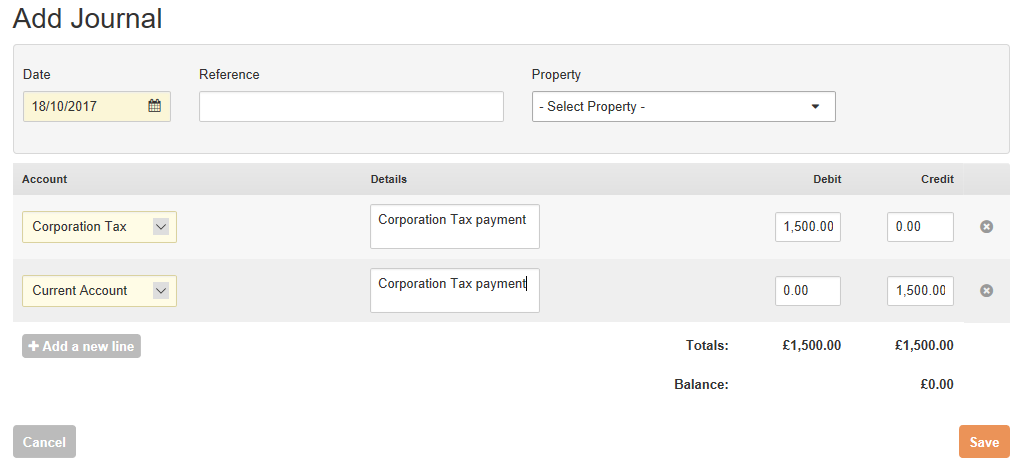

Each corporation tax payment could be recorded using the following journal entries. In this example the payment is £1500.

If you prefer to first record your corporation tax liability and then later record the corporation tax payment, you will need to do the following:

Firstly, create a liability account called Provision for Corporation Tax in the way outlined above, then post the following journal entries:

- When tax is calculated:

Debit Corporation Tax (Equity) <Corporation Tax Amount>

Credit Provision for Corporation Tax (Liability) <Corporation Tax Amount>

- And when tax is paid to HMRC:

Debit Provision for Corporation Tax (Liability) <Corporation Tax Amount>

Credit Business Bank Account <Corporation Tax Amount>

Customer support service by UserEcho