Recording a Property Sale

When a property has been sold, there are three sections that need to be updated:

- Record the date of the sale and the amount

- Record any income received

- Close the mortgage (if there was one)

Record the date of the sale and the amount

In Property Manager > Properties > click on the property > Edit Property and record the date and amount under Selling Details.

Record any income received

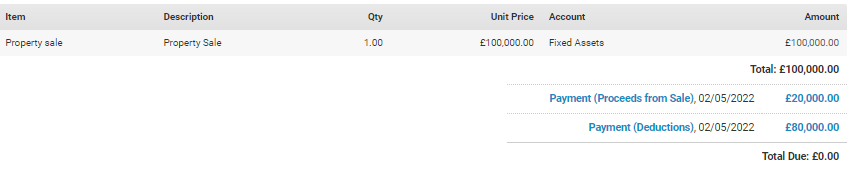

Consider the following example: a property is sold for £100,000, the mortgage is £80,000 and you receive £20,000 in your bank.

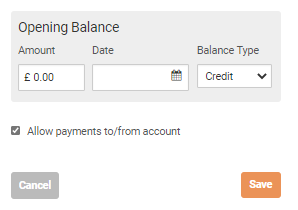

Before you start, go to Settings > Chart of Accounts > Edit Mispostings account and tick the box called Allow Payments From/To Account.

Go to Property Manager > Income and record the total value of the sale (in this case £100,000). Set the Income Item to Property Sale which will write the income to the Fixed Assets account.

With the income invoice entered, we now need to record two payments against it. One for the payment actually received in to the bank account, and one for the remainder of the sale amount.

For the payment that was paid in to the bank account, record a payment for £20,000 set to the bank account.

For any portion of the sale amount that has been deducted to cover fees or repay a mortgage, record a payment to the Mispostings account (£80,000).

Expenses

For any fees, enter these into Property Manager > Expenses > Add Expense.

The Cost Type should be Property Selling Costs for anything you want to have appear on the Capital Gains report.

If the fees have been deducted from the sale amount, record the payment from the Mispostings account. If the fees have been paid directly, simply record a payment from your bank account against the expense.

Close the mortgage

Go to Finance Manager > Mortgages/Loans > click on the mortgage and click Close Mortgage at the bottom of the screen. Enter the date that the mortgage closed and select Capital Repayment and select the account that the money came from to pay off the mortgage. If the money came from the solicitor, select Mispostings.

Customer support service by UserEcho